Personal Loans Grow

The trend of taking loans among people is increasing rapidly so the number of borrowers in the country is also increasing. According to a recent report, people have set a record for borrowing.

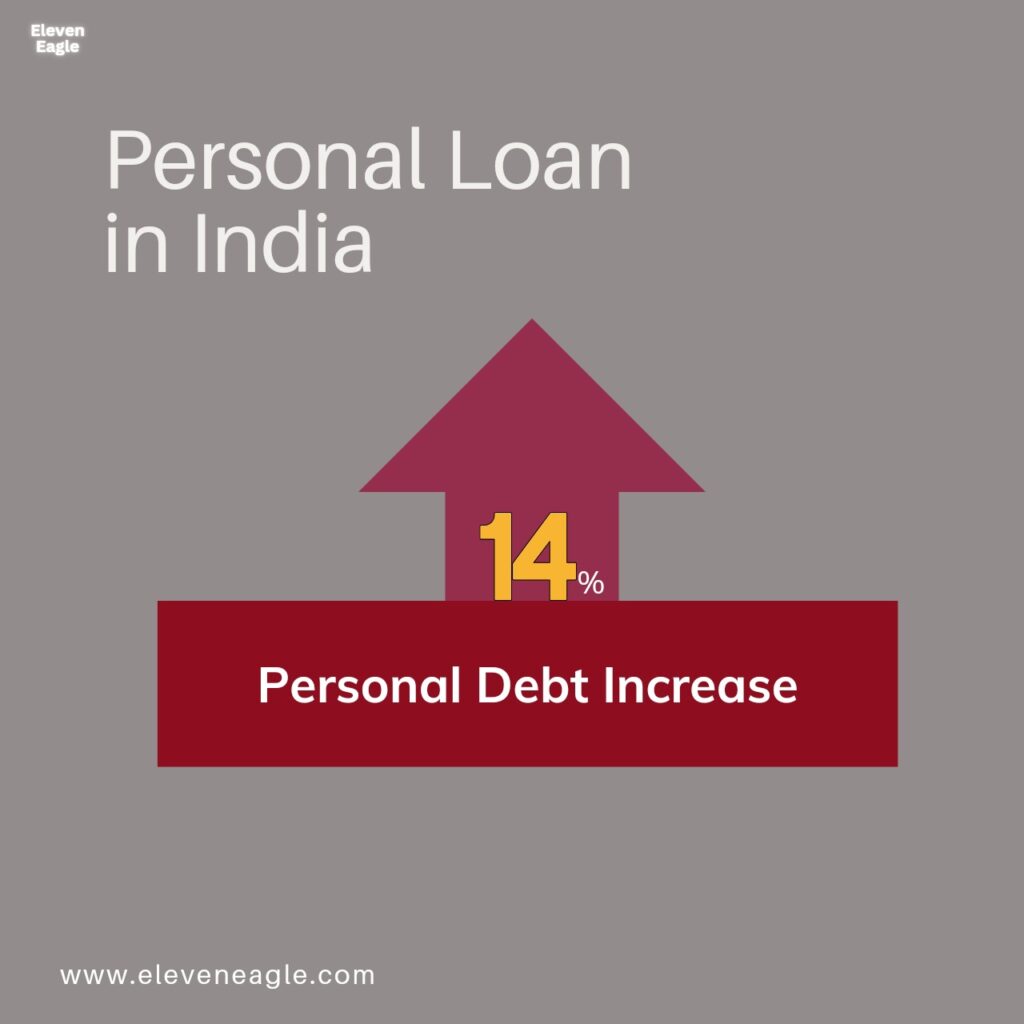

Gold and Credit Cards Lead the Way

People borrowed the most through credit cards and gold, so personal debt increased by 14 percent.

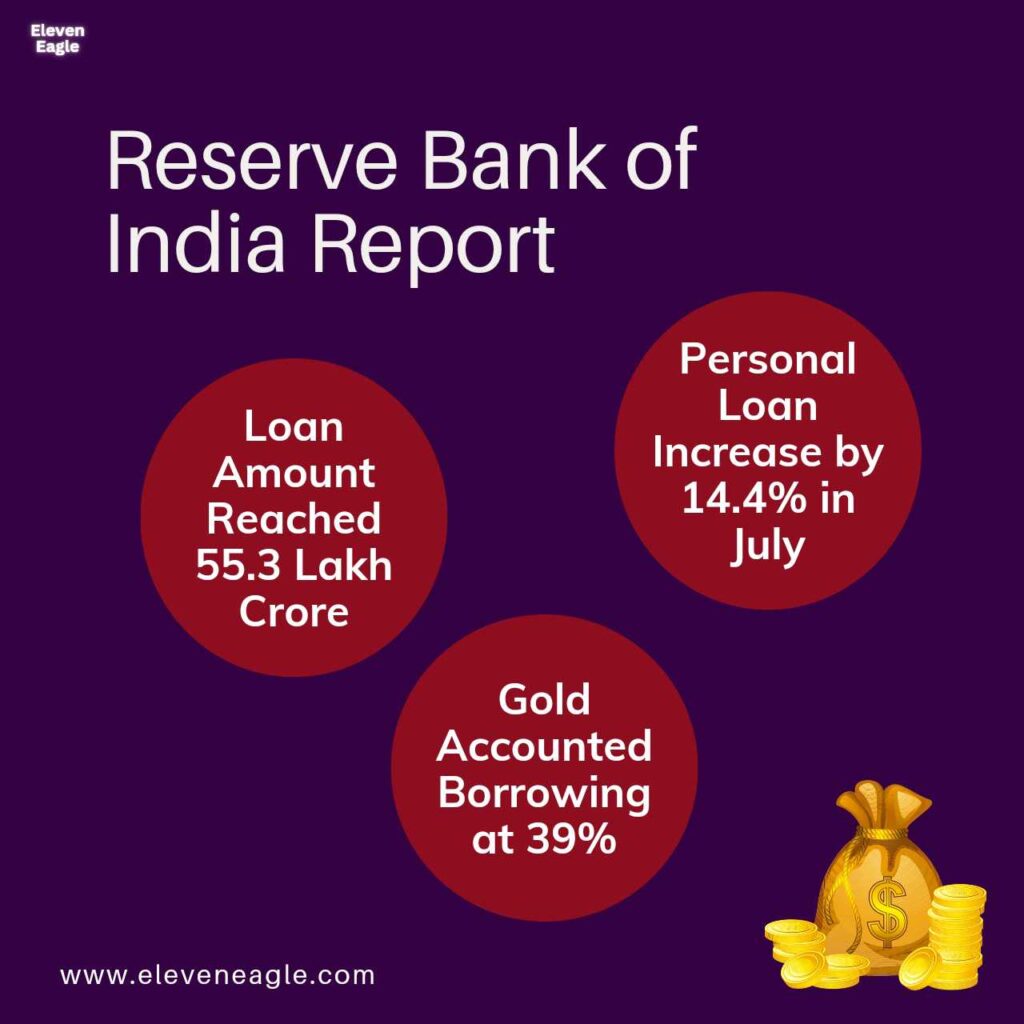

According to the Reserve Bank of India report, personal loans increased by 14.4 per cent in July. With this, the loan amount has reached to Rs 55.3 lakh crore. Gold accounted for the highest borrowing at 39 percent, while credit card borrowing was second only to gold.

Credit card arrears also increased

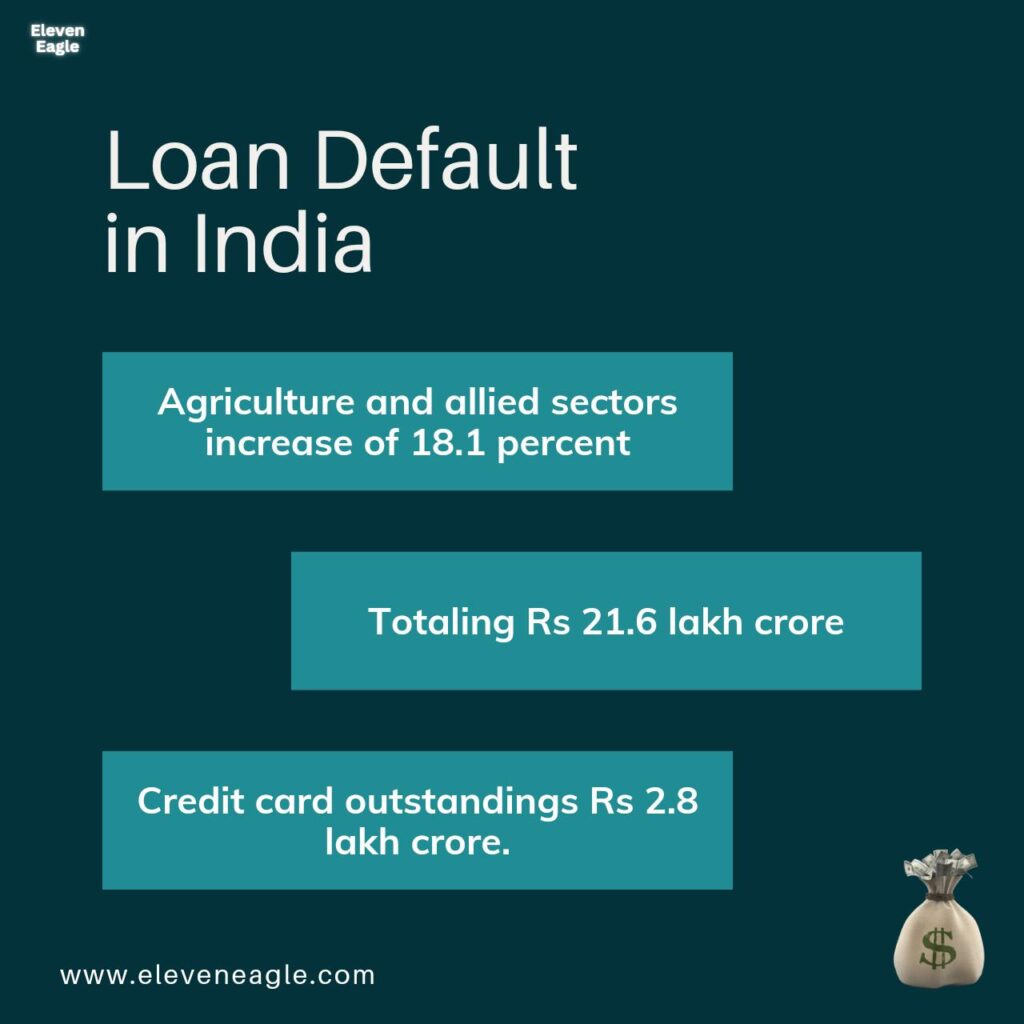

According to the report, outstanding loans in the agriculture and allied sectors showed an increase of 18.1 percent, totaling Rs 21.6 lakh crore. Another shocking fact has come out in this report. The number of customers with credit card arrears is increasing rapidly.

Also read this: India’s Billionaires: A Growing Trend, But What About the Common Man?

That means they took out a loan or spent money on the card but didn’t pay the bill. The report states that credit card outstandings have grown by 22 percent year-on-year to approximately Rs 2.8 lakh crore.

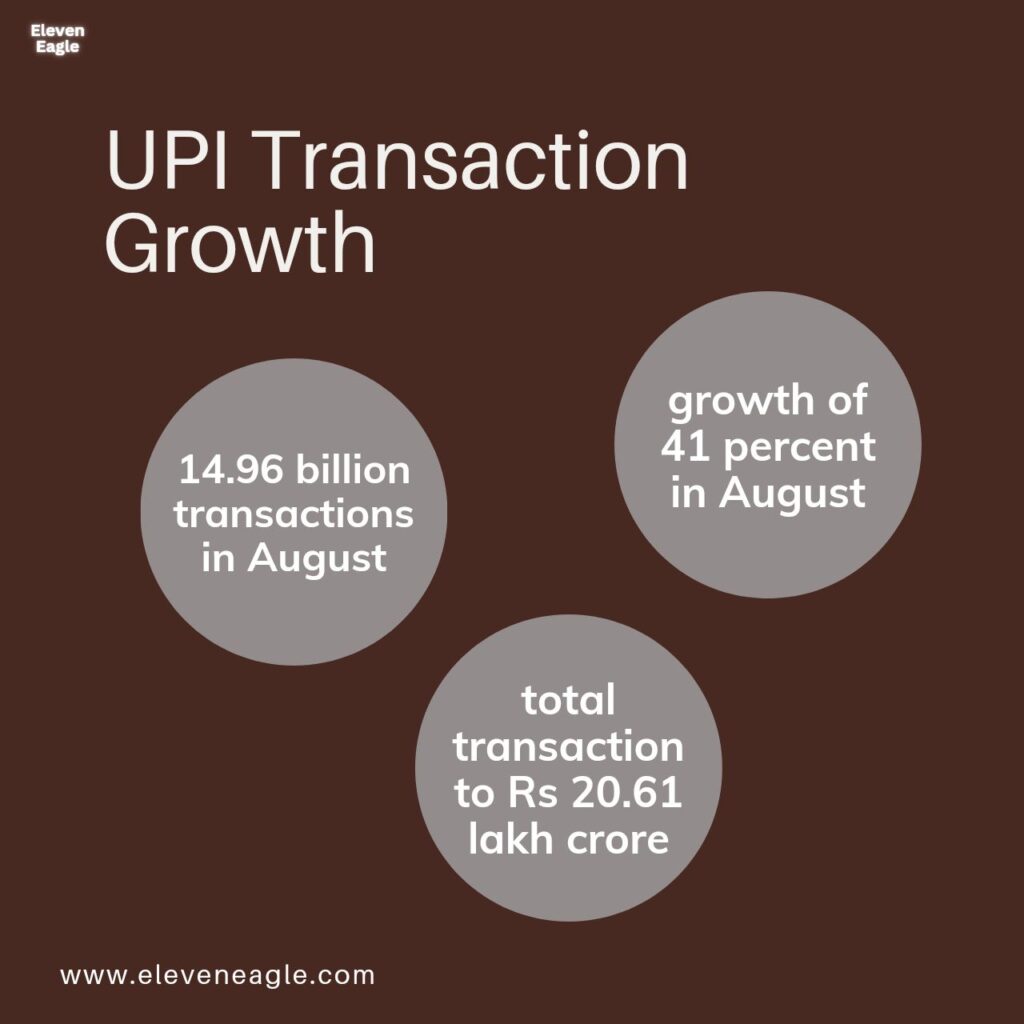

UPI transactions grew by 41% in August

UPI recorded a record 14.96 billion transactions in the month of August, a growth of 41 percent (year-on-year). With this, the total transaction amount has reached to Rs 20.61 lakh crore. This is a 31 percent increase compared to the same period last year.

Also read this: Uttar Pradesh Digital Media Policy; Influencers Will Get Upto 8 Lakh Salary

This information has been obtained from the data of National Payments Corporation of India (NPCI). UPI transactions have crossed Rs 20 lakh crore for four consecutive months.

Conclusion

The surge in personal loans reflects a growing reliance on credit to meet financial needs. However, the rise in credit card arrears underscores the importance of responsible borrowing and timely repayments. As India’s economy continues to expand, it is crucial to monitor these trends to ensure financial stability.

Also read this:

• Telegram’s Troubles: A Global Dilemma